Navigating the Indian financial landscape can be thrilling yet complex, with stocks and real estate often taking center stage. However, there’s an overlooked investment avenue that should not be ignored: debt instruments. Incorporating debt instruments like bonds into your investment strategy is not just wise, but essential.

Debt instruments, particularly bonds, offer stability in uncertain times. They provide fixed returns at regular intervals, serving as a reliable source of income, especially useful during market disruptions like the COVID-19 pandemic. Indian government bonds acted as a financial anchor for many portfolios, offering steady interest payments when other investment avenues were underperforming.

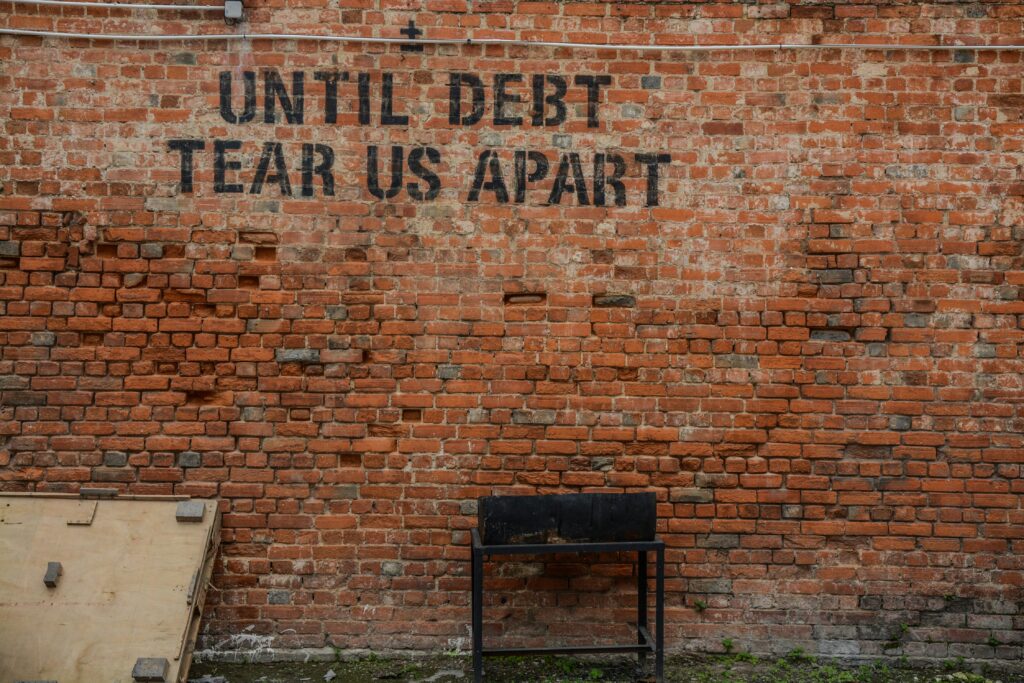

Balancing risk is crucial in investing, and the 60/40 rule – allocating 60% to stocks and 40% to bonds – is a strategy many investors swear by. Bonds provide stability when the stock market is volatile, creating a balance between growth and stability. This is particularly important in India, where market swings can be significant due to policy changes, global market influences, and economic reforms.

Debt instruments, especially government bonds, are safer than stocks. Investing in government bonds in India, with its burgeoning economy and dynamic financial reforms, provides a sense of security that is hard to match.

Bonds also offer steady income streams, making them appealing to retirees or those seeking supplemental income. The periodic interest from bonds can be a lifeline in a country like India, known for its culture of savings and financial prudence.

Some debt instruments, such as inflation-linked bonds, guard against inflation. Their payouts increase with inflation, preserving the investment’s real value. With unpredictable inflation rates in India, incorporating these instruments in a portfolio is a strategic move to preserve purchasing power.

Incorporating debt instruments into an investment portfolio is a step towards achieving a balanced, resilient financial future. The combination of stability, risk management, safety, regular income, and inflation protection that these instruments offer is invaluable in the evolving Indian economy. Embracing debt instruments is not just about diversifying investments; it’s about securing financial well-being in an ever-changing economic landscape.